March 6, 2022

Livable California on March 5 presented to its members a quick look at the 28 most worrisome/most promising laws under consideration by the California State Legislature for 2022 , including a few bills still alive from 2021.

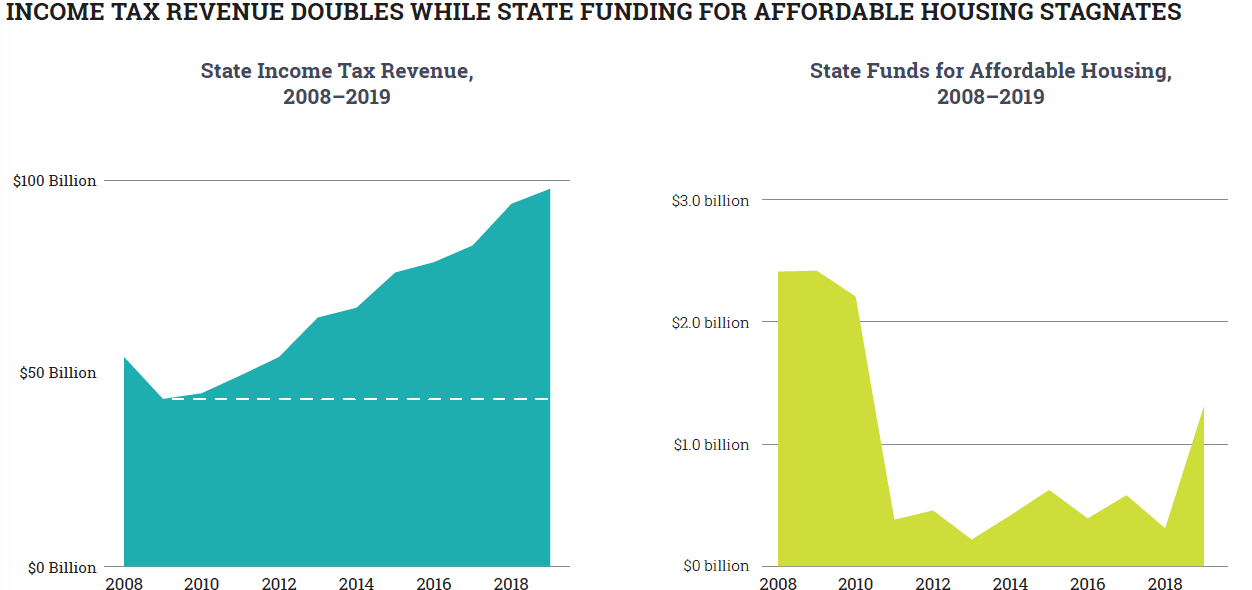

Our statewide membership, which is made up of city officials, community organizations, environmental advocates, homeowner groups, affordable housing advocates, urban planners, transit experts, homeless advocates and other concerned parties, discussed the years of missteps in the State Capitol. Elected leaders in Sacramento have approved bills that fuel real estate speculation. But they have repeatedly failed to significantly finance and build low-income housing for working-class Californians. Our low-income housing crisis has clearly worsened.

Below is our summary of the 28 bills we discussed on March 5 with our members. In some cases we include our views of the proposed bills.

Livable California’s Working List of 28 Possible Good & Bad Bills

Assembly Bills:

AB 682 (Bloom – D) Planning and zoning: density bonuses: cohousing buildings.

Summary: Existing law, commonly referred to as the Density Bonus Law, requires a city or county to provide a developer that proposes a housing development within the city or county with a density bonus and other incentives or concessions, as specified, if the developer agrees to construct, among other options, specified percentages of units for moderate-income, lower income, or very low income households and meets other requirements.

This bill would additionally require that a density bonus be provided under these provisions to a developer who agrees to construct a housing development that is a cohousing building, as defined, that meets specified requirements and will contain either 10% of the total square footage for lower income households, as defined, or 5% of the total square footage for very low income households, as defined. The bill would prohibit the city, county, or city and county from requiring any minimum unit size requirements or minimum bedroom requirements in conflict with the bill’s provisions, requirement for the project to provide private open space, or maximum limit on density with respect to a cohousing building eligible for a density bonus under these provisions. The bill would also make a technical change to the Density Bonus Law by deleting certain duplicative provisions. This bill contains other related provisions and other existing laws. Needs further analysis. Livable California strongly opposed a similar law by this author in 2020, AB 3173, which failed.

AB 1206 (Bennett – D) Property taxation: affordable housing: welfare exemption.

Summary: (1) Existing property tax law, in accordance with the California Constitution, provides for a “welfare exemption” for property used exclusively for religious, hospital, scientific, or charitable purposes and that is owned or operated by certain types of nonprofit entities, if certain qualifying criteria are met. Under existing property tax law, property that meets these requirements that is used exclusively for rental housing and related facilities is entitled to a partial exemption, equal to that percentage of the value of the property that is equal to the percentage that the number of units serving lower income households represents of the total number of residential units, in any year that any of certain criteria apply, including that the property be subject to a legal restriction that provides that units designated for use by lower income households are continuously available to or occupied by lower income households, at rents not exceeding specified limits. For the 2018–19 fiscal year through the 2027–28 fiscal year, in the case of an owner of property receiving a low-income housing tax credit under specified federal law, existing property tax law requires that a unit continue to be treated as occupied by a lower income household for these purposes if the occupants were lower income households on the lien date in the fiscal year in which their occupancy of the unit commenced and the unit continues to be rent restricted, notwithstanding an increase in the income of the occupants of the unit to 140% of area median income, adjusted for family size.

This bill, for the 2022–23 fiscal year through the 2027–28 fiscal year, would require that a unit continue to be treated as occupied by a lower income household, as described above, if the owner is a community land trust whose land is leased to low-income households, subject to a contract that complies with specified requirements. This bill would require a claim for a welfare exemption pursuant to this requirement to be accompanied by an affidavit containing specified information regarding the units for which the exemption is claimed and would provide that the affidavit is not subject to public disclosure. This bill contains other related provisions and other existing laws. We will monitor. Possible support.

AB 1602 (McCarty – D) Student, faculty, and staff housing: California Student Housing, the “Revolving Loan Fund Act of 2022”

Summary: Would establish the California Student Housing Revolving Loan Fund Act of 2022 to provide zero-interest loans to qualifying applicants of the University of California, the California State University, and the California Community Colleges for the purpose of constructing affordable student housing and faculty and staff housing, as specified. The bill would establish the California Student Housing Revolving Fund as a continuously appropriated fund in the State Treasury, thereby making an appropriation. The bill would state the intent of the Legislature to appropriate $5,000,000,000 for purposes of the housing loans. A Livable California board member is analyzing.

AB 1755 (Levine D) Homeowners’ insurance: home hardening.

Summary: Existing law creates the Department of Insurance to regulate the business of insurance. Existing law generally regulates classes of insurance, including homeowners’ insurance. Existing law prohibits an insurer, for one year after the declaration of a state of emergency, from canceling or refusing to renew a residential property insurance policy solely because the property is in an area in which a wildfire occurred.

This bill would require an admitted insurer licensed to issue homeowners’ insurance policies to issue a policy to a homeowner who has hardened their home against fire, regardless of the home’s location, on and after January 1, 2025, and would require an insurer to make conforming changes to its internet website and print materials on or before July 1, 2025. The bill would create the Wildfire Protection Grant Program, under which the department would be required to award grants of up to $10,000 each to help homeowners pay for costs associated with wildfire mitigation improvements. The bill would require the department to promulgate regulations to define home hardening for required issuance of homeowners’ insurance policies and to administer the Wildfire Protection Grant Program. A Livable California volunteer attorney is analyzing.

AB 1910 (Garcia, Cristina D) Publicly owned golf courses: conversion: affordable housing.

Summary: Existing law establishes the Department of Housing and Community Development and requires it to, among other things, administer various programs intended to fund the acquisition of property to develop or preserve affordable housing.

This bill would, upon appropriation by the Legislature, require the department to administer a program to provide incentives in the form of grants to local agencies that enter into a development agreement to convert a golf course owned by the local agency into housing and publicly accessible open space, as specified. This bill would require the department to award funding in accordance with the number of affordable units a local agency proposes to construct. A Livable California board member is analyzing.

AB 2053 (Lee – D) The Social Housing Act.

Summary: Existing law establishes the Department of Housing and Community Development and sets forth its powers and duties. Existing law creates a housing authority in each county or city, which functions upon the adoption of a specified resolution by the relevant governing body. Existing law authorizes these housing authorities, within their jurisdictions, to construct, reconstruct, improve, alter, or repair all or part of any housing project. Existing law establishes various programs that provide housing assistance.

This bill would enact the Social Housing Act and would create the California Housing Authority, as an independent state body, the mission of which would be to produce and acquire social housing developments for the purpose of eliminating the gap between housing production and regional housing needs assessment targets, as specified. The bill would prescribe a definition of social housing that would describe, in addition to housing owned by the authority, housing owned by other entities, as specified, provided that all social housing developed by the authority would be owned by the authority. The bill would prescribe the composition of the California Housing Authority Board, which would govern the authority, and would be composed of appointed members and members who are elected by residents of social housing developments, as specified. The bill would prescribe the powers and duties of the authority and the board. The bill would provide that the authority is bound to revenue neutrality, as defined, and would require the authority to recover the cost of development and operations over the life of its properties through the mechanism of rent cross-subsidization, as defined. The bill would require the authority to prioritize the development of specified property, including vacant parcels and parcels near transit, and would prescribe a process for the annual determination of required social housing units. Under the bill, social housing would accommodate a mix of household income ranges and would provide specified protections for residents, who would participate in the operation and management of the units in which they reside. This bill contains other related provisions. No position. Livable California will give high priority to analyzing.

AB 2063 (Berman – D) Density bonuses: affordable housing impact fees.

Summary: Existing law, known as the Density Bonus Law, requires a city or county to provide a developer that proposes a housing development in the city or county with a density bonus and other incentives or concessions for the production of lower income housing units, or for the donation of land within the development, if the developer agrees to, among other things, construct a specified percentage of units for very low income, low-income, or moderate-income households or qualifying residents, including lower income students. Existing law requires the amount of a density bonus and the number of incentives or concessions a qualifying developer receives to be pursuant to a certain formula based on the total number of units in the housing development, as specified. Existing law prohibits affordable housing impact fees, including inclusionary zoning fees and in-lieu fees, from being imposed on a housing development’s affordable units.

This bill would prohibit affordable housing impact fees, including inclusionary zoning fees, in-lieu fees, and public benefit fees, from being imposed on a housing development’s density bonus units. By imposing new restrictions on the ability of a local government to impose affordable housing impact fees, the bill would impose a state-mandated local program. This bill contains other related provisions and other existing laws. Likely Oppose. Livable California will give high priority to analyzing.

AB 2097 (Friedman – D) Residential and commercial development: remodeling, renovations, and additions: parking requirements.

Summary: The Planning and Zoning Law requires each county and city to adopt a comprehensive, long-term general plan for its physical development, and the development of certain lands outside its boundaries, that includes, among other mandatory elements, a land use element and a conservation element. Existing law permits variances to be granted from parking requirements of a zoning ordinance for nonresidential development if the variance will be an incentive to the development and facilitates access to the development by public transit patrons.

This bill would prohibit a public agency from imposing a minimum automobile parking requirement, or enforcing a minimum automobile parking requirement, on residential, commercial, or other development if the development is located on a parcel that is within one-half mile of public transit, as defined. When a project provides parking voluntarily, the bill would authorize a public agency to impose specified requirements on the voluntary parking. The bill would prohibit these provisions from reducing, eliminating, or precluding the enforcement of any requirement imposed on a new multifamily or nonresidential development to provide electric vehicle supply equipment installed parking spaces or parking spaces that are accessible to persons with disabilities. The bill would exempt certain commercial parking requirements if the bill conflicts with a contractual agreement of the public agency executed before January 1, 2023. This bill contains other related provisions and other existing laws. Livable California will oppose. We urge interested parties to read the numerous studies showing that owning and using a car has a dramatic, direct, positive impact on the income and lives of low-income workers and the poor. The ongoing campaign in the State Capitol against providing parking for working-class Californians and struggling renters is ill-advised.

AB 2547 (Nazarian – D) Housing Stabilization to Prevent and End Homelessness Among Older Adults and People with Disabilities Act.

Summary: Existing law, the Mello-Granlund Older Californians Act, establishes the California Department of Aging and states that the mission of the department is to provide leadership to area agencies on aging in developing systems of home- and community-based services that maintain individuals in their own homes or least restrictive homelike environments. Existing law establishes the Senior Housing Information and Support Center within the department to serve various functions, including, among others, serving as a clearinghouse for information for seniors and their families regarding available innovative resources and senior services and promoting education and training for professionals who work directly with seniors in order to maximize opportunities for independent living.

This bill, upon appropriation by the Legislature, would require the California Department of Aging, by December 31, 2023, to create and administer the Housing Stabilization to Prevent and End Homelessness Among Older Adults and People with Disabilities Program. The bill would require the department, in administering the program, to offer competitive grants to nonprofit community-based organizations, continuums of care, and public housing authorities to administer a housing subsidy program for older adults and persons with a disability that are experiencing homelessness or at risk of homelessness, as those terms are as defined. The bill would require the department, in establishing program guidelines, to prioritize communities where renters face high rates of poverty, displacement, gentrification, and homelessness. This bill contains other related provisions. Possible Support. Not fully analyzed by Livable California.

AB 2593 (Boerner Horvath – D) Coastal resources: coastal development permits: blue carbon projects.

Summary: Existing law, the California Coastal Act of 1976, among other things, requires anyone wishing to perform or undertake any development in the coastal zone, except as specified, in addition to obtaining any other permit required by law from any local government or from any state, regional, or local agency, to obtain a coastal development permit from the California Coastal Commission, as provided.

This bill would require the commission to require an applicant with a public project, as defined, seeking a coastal development permit to, where feasible, also build or contribute to a blue carbon project, as defined. The bill would provide that, when possible, existing state grant programs may be used to fund, and give funding priority to, blue carbon projects to the extent not in conflict with the grant program, as provided. Possible Support. Not fully analyzed by Livable California.

AB 2620 (Valladares – R) Income taxes: credits: telecommuting: transfer of funds.

Summary: The Personal Income Tax Law and the Corporation Tax Law allow various credits against the taxes imposed by those laws. Existing law establishes the Greenhouse Gas Reduction Fund and requires all moneys, except as provided, collected by the State Air Resources Board from the auction or sale of allowances, as specified, to be deposited into the fund and be available for appropriation by the Legislature.

This bill, for taxable years beginning on or after January 1, 2023, and before January 1, 2028, would allow a credit against those taxes to a qualified taxpayer, as defined, in an amount equal to one thousand dollars ($1,000) per qualified employee, as defined. The bill would require a taxpayer claiming the credit to retain documentation, including, but not limited to, a telecommuting agreement signed by the taxpayer and employee, demonstrating that the employee telecommutes at least 25 hours per week. The bill would require, upon request by the Franchise Tax Board, a taxpayer to provide, in a manner prescribed by the board, that documentation for purposes of verifying the taxpayer’s eligibility for the credit. The bill would require board to annually determine the amount of revenue lost as a result of the credits and to report the amount to the Controller. The bill would authorize the Controller to transfer moneys, to the extent permissible, from the Greenhouse Gas Reduction Fund to the General Fund up to the amount of revenue lost as a result of the credits.This bill contains other related provisions and other existing laws. Possible Support. Not fully analyzed by Livable California.

AB 2625 (Ting – D) Surplus land: public park and recreational purposes: development.

Summary: Existing law requires land retained or transferred for public park and recreational purposes by a local agency to be developed within 10 years and used for at least 25 years, following the retention or transfer for those purposes in accordance with the general plan for the city or county in which the land is located. Existing law otherwise requires the land to be sold by the local agency and the funds received from the sale to be used for highway purposes. Existing law also provides that if the land originally had been transferred for those purposes, it shall revert to the original acquiring local agency for the sale.

This bill instead says “Land retained or transferred for public park and recreational purposes pursuant to Section 54231 shall be developed within 5 years, and shall be used for at least 30 years. … [If the local park is not developed within 5 years] the land shall be sold by the local agency, and the funds from the sale “shall be used for highway purposes.” This bill contains other related provisions and other existing laws. Possible Oppose. This troubling bill has not been fully analyzed by Livable California.

AB 2749 (Quirk-Silva – D) Communications: California Advanced Services Fund.

Summary: Existing law vests the Public Utilities Commission with regulatory authority over public utilities, including telephone corporations. Existing law requires the commission to develop, implement, and administer the California Advanced Services Fund (CASF) to encourage deployment of high-quality advanced communications services to all Californians that will promote economic growth, job creation, and the substantial social benefits of advanced information and communications technologies. Existing law authorizes the commission to impose a surcharge, until December 31, 2032, to collect up to $150,000,000 per year for deposit into the CASF. Existing law requires the commission to establish specified accounts within the CASF, including the Broadband Infrastructure Grant Account and the Federal Funding Account. Existing law requires the commission, in approving infrastructure projects funded through the Broadband Infrastructure Grant Account, to approve projects that provide last-mile broadband access to households that are unserved by an existing facility-based broadband provider.

This bill would expand that requirement to require the commission to approve projects that provide last-mile broadband access to areas that include those households. This bill contains other related provisions and other existing laws. Possible Support. Not fully analyzed by Livable California.

AB 2750 (Bonta, Mia – D) Department of Technology: digital equity plan.

Summary: Existing law establishes the Department of Technology within the Government Operations Agency, which is supervised by the Director of Technology. Existing law charges the director and the department with various duties in creating and managing the information technology policy of the state.

This bill would require the department, in consultation with the public, the Public Utilities Commission, and the California Broadband Council, to develop a state digital equity plan. The bill would require that the plan include, among other things, the identification of barriers to digital equity faced by specified populations, as provided, and measurable objectives towards achieving digital equity among those populations. The bill would require the department to seek all available federal funding for purposes of developing and implementing the plan. Possible Support. Not fully analyzed by Livable California.

AB 2751 (Garcia, Eduardo – D) “Affordable Internet and Net Equality Act of 2022.”

Summary: Under existing law, the Public Utilities Commission has regulatory authority over public utilities, including telephone corporations. Pursuant to its existing authority, the commission supervises administration of the state’s telecommunications universal service programs, including programs financed through the California Teleconnect Fund Administrative Committee Fund and California Advanced Services Fund, which provide high-quality advanced communication services, also known as broadband services.

This bill, the Affordable Internet and Net Equality Act of 2022, would require the commission, in coordination with the Department of Technology and the Department of General Services, to develop and establish the Net Equality Program. The bill would require the state and state agencies to only do business with an internet service provider offering affordable home internet service to households participating in certain public assistance programs, as specified. The bill would define affordable home internet service to mean internet service costing no more than $20 per month and that meets specified minimum speed requirements. The bill would require these internet service providers to establish a telephone number to sign up eligible households and would require these providers to advertise the availability of affordable home internet service, among other requirements placed on these providers. The bill would also make its provisions severable. This bill contains other related provisions and other existing laws. Possible Support. Not fully analyzed by Livable California.

AB 2752 (Wood – D) Broadband infrastructure: mapping.

Summary: Existing law vests the Public Utilities Commission with regulatory authority over public utilities, including telephone corporations. Existing law requires the commission to develop, implement, and administer the California Advanced Services Fund program to encourage deployment of high- quality advanced communications services to all Californians that will promote economic growth, job creation, and the substantial social benefits of advanced information and communications technologies. Existing law requires the commission, in collaboration with relevant state agencies and stakeholders, to maintain and update a statewide, publicly accessible, and interactive map showing the accessibility of broadband service in the state, as provided. This bill would require the commission, in collaboration with relevant state agencies and stakeholders, to additionally include all developed last-mile broadband service connections from the statewide open-access middle-mile broadband network on that interactive map. Possible Support. Not fully analyzed by Livable California.

AB 2762 (Bloom – D) Housing: parking lots at public parks.

Summary: Existing law, the Planning and Zoning Law, requires each county and city to adopt a comprehensive, long-term general plan for the physical development of the county or city, and specified land outside boundaries, that includes, among other mandatory elements, a housing element.

This bill would state that it is the intent of the Legislature to enact subsequent legislation that would allow local agencies to build affordable housing on parking lots that serve public parks and recreational facilities, as provided. Possible Oppose. Livable California will analyze when this bill’s incomplete language is completed and published.

ACA 1 (Aguiar-Curry – D) Local government financing: affordable housing and public infrastructure: voter approval.

Summary: (1) The California Constitution prohibits the ad valorem tax rate on real property from exceeding 1% of the full cash value of the property, subject to certain exceptions. This [ballot] measure would create an additional exception to the 1% limit that would authorize a city, county, city and county, or special district to levy an ad valorem tax to service bonded indebtedness incurred to fund the construction, reconstruction, rehabilitation, or replacement of public infrastructure, affordable housing, or permanent supportive housing, or the acquisition or lease of real property for those purposes, if the proposition proposing that tax is approved by 55% of the voters of the city, county, or city and county, as applicable, and the proposition includes specified accountability requirements. The measure would specify that these provisions apply to any city, county, city and county, or special district measure imposing an ad valorem tax to pay the interest and redemption charges on bonded indebtedness for these purposes that is submitted at the same election as this measure. This bill contains other related provisions and other existing laws. Livable California will analyze.

ACA 7 (Muratsuchi – D) Local government: police power: municipal affairs: land use and zoning.

Summary: The California Constitution authorizes a city or county to make and enforce within its limits all local, police, sanitary, and other ordinances and regulations not in conflict with general laws, which is also known as the police power. Existing law also authorizes a county or city to adopt a charter, as provided. The California Constitution authorizes a city governed under a charter make and enforce all ordinances and regulations in respect to municipal affairs and provides that, with respect to municipal affairs, a city charter supersedes all inconsistent laws. Under the California Constitution, the power to regulate land use is within the scope of the police power, and is also generally considered to be a municipal affair, for purposes of these provisions.

This measure would provide that a county or city ordinance or regulation enacted under the police power that regulates the zoning or use of land within the boundaries of the county or city would prevail over conflicting general laws, with specified exceptions. The measure, in the event of the conflict with a state statute, would also specify that a city charter provision, or an ordinance or regulation adopted pursuant to a city charter, that regulates the zoning or use of land within the boundaries of the city is deemed to address a municipal affair and prevails over a conflicting state statute, except that the measure would provide that a court may determine that a city charter provision, ordinance, or regulation addresses either a matter of statewide concern or a municipal affair if it conflicts with specified state statutes. The measure would make findings in this regard and provide that its provisions are severable. Livable California will support this improvement to the California Constitution. We are further analyzing.

State Senate Bills:

SB 6 (Caballero – D) Local planning: housing: commercial zones.

Summary: The Planning and Zoning Law requires each county and city to adopt a comprehensive, long-term general plan for its physical development, and the development of certain lands outside its boundaries, that includes, among other mandatory elements, a housing element. Existing law requires that the housing element include, among other things, an inventory of land suitable and available for residential development. If the inventory of sites does not identify adequate sites to accommodate the need for groups of all households pursuant to specified law, existing law requires the local government to rezone sites within specified time periods and that this rezoning accommodate 100% of the need for housing for very low and low-income households on sites that will be zoned to permit owner- occupied and rental multifamily residential use by right for specified developments.

This bill, the Neighborhood Homes Act, would deem a housing development project, as defined, an allowable use on a neighborhood lot, which is defined as a parcel within an office or retail commercial zone that is not adjacent to an industrial use. The bill would require the density for a housing development under these provisions to meet or exceed the density deemed appropriate to accommodate housing for lower income households according to the type of local jurisdiction, including a density of at least 20 units per acre for a suburban jurisdiction. The bill would require the housing development to meet all other local requirements for a neighborhood lot, other than those that prohibit residential use, or allow residential use at a lower density than that required by the bill. The bill would provide that a housing development under these provisions is subject to the local zoning, parking, design, and other ordinances, local code requirements, and procedures applicable to the processing and permitting of a housing development in a zone that allows for the housing with the density required by the act. If more than one zoning designation of the local agency allows for housing with the density required by the act, the bill would require that the zoning standards that apply to the closest parcel that allows residential use at a density that meets the requirements of the act would apply. If the existing zoning designation allows residential use at a density greater than that required by the act, the bill would require that the existing zoning designation for the parcel would apply. The bill would also require that a housing development under these provisions comply with public notice, comment, hearing, or other procedures applicable to a housing development in a zone with the applicable density. The bill would require that the housing development is subject to a recorded deed restriction with an unspecified affordability requirement, as provided. The bill would require that a developer make specified certifications to the local agency, including, among others, that all contractors and subcontractors performing work on the project will be required to pay prevailing wages, as provided. For specified projects, the developer would be required to seek bids containing an enforceable commitment that all contractors and subcontractors performing work on the project will use a skilled and trained workforce, as defined. The bill would require a local agency to require that a rental of any unit created pursuant to the bill’s provisions be for a term longer than 30 days. The bill would authorize a local agency to exempt a neighborhood lot from these provisions in its land use element of the general plan if the local agency concurrently reallocates the lost residential density to other lots so that there is no net loss in residential density in the jurisdiction, as provided. The bill would specify that it does not alter or affect the application of any housing, environmental, or labor law applicable to a housing development authorized by these provisions, including, but not limited to, the California Coastal Act, the California Environmental Quality Act, the Housing Accountability Act, obligations to affirmatively further fair housing, and any state or local affordability laws or tenant protection laws. The bill would require an applicant of a housing development under these provisions to provide notice of a pending application to each commercial tenant of the neighborhood lot. The bill would repeal these provisions on January 1, 2029. This bill contains other related provisions and other existing laws. Possible Oppose. We will further analyze. Similar to this author’s badly flawed SB 1385 proposed in 2020 and SB 6 proposed in 2021.

SB 15 (Portantino – D) Housing development: incentives: rezoning of idle retail sites.

Summary: Existing law establishes, among other housing programs, the Workforce Housing Reward Program, which requires the Department of Housing and Community Development to make local assistance grants to cities, counties, and cities and counties that provide land use approval to housing developments that are affordable to very low and low-income households.

This bill, upon appropriation by the Legislature in the Budget Act or other act, would require the department to administer a program to provide incentives in the form of grants allocated as provided to local governments that rezone idle sites used for a big box retailer or a commercial shopping center to instead allow the development of housing, as defined. The bill would define various terms for these purposes. In order to be eligible for a grant, the bill would require a local government, among other things, to apply to the department for an allocation of grant funds and provide documentation that it has met specified requirements, including certain labor-related requirements. The bill would make the allocation of these grants subject to appropriation by the Legislature in the annual Budget Act or other statute. This bill contains other related provisions. We will support and further analyze. This bill is similar to this author’s well-reasoned SB 1299, which unfortunately died in 2020.

SB 843 (Glazer – D) Taxation: renters’ credit.

Summary: The Personal Income Tax Law authorizes various credits against the taxes imposed by that law, including a credit for qualified renters in the amount of $120 for spouses filing joint returns, heads of household, and surviving spouses if adjusted gross income is $50,000, as adjusted, or less, and in the amount of $60 for other individuals if adjusted gross income is $25,000, as adjusted, or less. Existing law requires the Franchise Tax Board to annually adjust for inflation these adjusted gross income amounts. For 2020, the adjusted gross income limit is $87,066 and $43,533, respectively. Existing law requires any bill authorizing a new tax credit to contain, among other things, specific goals, purposes, and objectives that the tax credit will achieve, detailed performance indicators, and data collection requirements.

This bill, for taxable years beginning on or after January 1, 2022, and before January 1, 2027, and only when specified in a bill relating to the Budget Act, would increase the credit amount for a qualified renter to $1,000, as provided. In the event the increased credit amount is not specified in a bill relating to the Budget Act, the existing credit amounts of $120 and $60, as described above, respectively, would be the credit amounts for that taxable year. The bill would require the Franchise Tax Board to annually recompute for inflation the credit amount for taxable years on or after January 1, 2023, and before January 1, 2027, except as provided. The bill would provide findings and declarations relating to the goals, purposes, and objectives of this credit. This bill contains other related provisions and other existing laws. Possible Support. Livable California will further analyze.

SB 896 (Dodd – D) Wildfires: defensible space: grant programs: local governments.

Summary: Existing law requires a person who owns, leases, controls, operates, or maintains a building or structure in, upon, or adjoining a mountainous area, forest-covered lands, shrub-covered lands, grass-covered lands, or land that is covered with flammable material to maintain defensible space of 100 feet from each side. Existing law requires the Director of Forestry and Fire Protection to establish a statewide program to allow qualified entities, including counties and other political subdivisions of the state, to support and augment the Department of Forestry and Fire Protection in its defensible space and home hardening assessment and education efforts. Existing law requires the director to establish a common reporting platform that allows defensible space and home hardening assessment data, collected by the qualified entities, to be reported to the department.

This bill would require any local government entity that is qualified to conduct these defensible space assessments in very high and high fire hazard severity zones and that reports that information to the department, to report that information using the common reporting platform. The bill would require the department, on December 31, 2023, and annually thereafter, to report to the Legislature all defensible space data collected through the common reporting platform, as provided. This bill contains other related provisions and other existing laws. Analysis underway by a Livable California volunteer attorney.

SB 897 (Wieckowski – D) Accessory dwelling units: junior accessory dwelling units.

Summary: (1) Existing law, the Planning and Zoning Law, authorizes a local agency, by ordinance or ministerial approval, to provide for the creation of accessory dwelling units in areas zoned for residential use, as specified. Existing law provides that an accessory dwelling unit may either be an attached or detached residential dwelling unit, and prescribes the minimum and maximum unit size requirements, height limitations, and setback requirements that a local agency may establish, including a 16-foot height limitation and a 4-foot side and rear setback requirement.

This bill would increase the maximum height limitation that may be imposed by a local agency on an accessory dwelling unit to 25 feet. This bill contains other related provisions and other existing laws. Livable California will oppose this attempt to allow three-story ADUs in single-family home yards. We are conducting further analysis.

SB 922 (Wiener D) California Environmental Quality Act: exemptions: transportation-related projects.

Summary: The California Environmental Quality Act (CEQA) requires a lead agency, as defined, to prepare, or cause to be prepared, and certify the completion of an environmental impact report on a project that it proposes to carry out or approve that may have a significant effect on the environment or to adopt a negative declaration if it finds that the project will not have that effect. CEQA also requires a lead agency to prepare a mitigated negative declaration for a project that may have a significant effect on the environment if revisions in the project would avoid or mitigate that effect and there is no substantial evidence that the project, as revised, would have a significant effect on the environment. CEQA, until January 1, 2030, exempts from its requirements bicycle transportation plans for an urbanized area for restriping of streets and highways, bicycle parking and storage, signal timing to improve street and highway intersection operations, and related signage for bicycles, pedestrians, and vehicles under certain conditions.

This bill would extend the above CEQA exemption indefinitely. The bill would also repeal the requirement that the bicycle transportation plan is for an urbanized area and would extend the exemption to an active transportation plan or pedestrian plan, or for a feasibility and planning study for active transportation, bicycle facilities, or pedestrian facilities. This bill contains other related provisions and other existing laws. Livable California will oppose this troubling bill. A Livable California board member is conducting further analysis.

SB 1292 (Stern D) Accessory dwelling units: setbacks.

Summary: The Planning and Zoning Law, among other things, provides for the creation of accessory dwelling units by local ordinance, or, if a local agency has not adopted an ordinance, by ministerial approval, in accordance with specified standards and conditions. Existing law prohibits a local agency’s accessory dwelling unit ordinance from imposing a setback requirement of more than 4 feet from the side and rear lot lines for an accessory dwelling unit that is not converted from an existing structure or a new structure constructed in the same location and to the same dimensions as an existing structure.

This bill would remove the above-described prohibition on a local agency’s accessory dwelling unit ordinance, and would instead provide that the rear and side yard setback requirements for accessory dwelling units may be set by the local agency. The bill would authorize an accessory dwelling unit applicant to submit a request to the local agency for an alternative rear and side yard setback requirement if the local agency’s setback requirements make the building of the accessory dwelling unit infeasible. The bill would prohibit any rear and side yard setback requirements established pursuant to these provisions from being greater than those in effect as of January 1, 2020. The bill would specify that if the local agency did not have an accessory dwelling unit ordinance as of January 1, 2020, the applicable rear and side yard setback requirement is 4 feet. This bill contains other related provisions and other existing laws. Possible support. Livable California is analyzing this bill.

SB 1404 (Stern D) California Environmental Quality Act: Oak Woodlands.

Summary: The California Environmental Quality Act (CEQA) requires a lead agency, as defined, to prepare, or cause to be prepared, and certify the completion of an environmental impact report on a project that it proposes to carry out or approve that may have a significant effect on the environment or to adopt a negative declaration if it finds that the project will not have that effect. CEQA also requires a lead agency to prepare a mitigated negative declaration for a project that may have a significant effect on the environment if revisions in the project would avoid or mitigate that effect and there is no substantial evidence that the project, as revised, would have a significant effect on the environment. CEQA requires a county to determine whether a project within its jurisdiction may result in a conversion of oak woodlands that will have a significant effect on the environment. CEQA requires the county to require certain oak woodlands mitigation alternatives if the county determines that there may be a significant effect to oak woodlands. CEQA exempts certain projects from this requirement.

This bill would instead require a public agency to determine whether a project within its jurisdiction may result in a conversion of oak woodlands that will have a significant effect on the environment and to require certain oak woodlands mitigation alternatives, and would make conforming changes. The bill would provide that the removal of 3 or more oak trees within an oak woodland constitutes a significant effect on the environment. By imposing duties on local public agencies, the bill would impose a state- mandated local program. This bill contains other related provisions and other existing laws. Possible Support. A Livable California volunteer attorney is analyzing this bill.

SCA 2 (Allen D) Public housing projects.

Summary: The California Constitution prohibits the development, construction, or acquisition of a low-rent housing project, as defined, in any manner by any state public body until a majority of the qualified electors of the city, town, or county in which the development, construction, or acquisition of the low-rent housing project is proposed approve the project by voting in favor at an election, as specified. This measure would repeal these provisions. Livable California will support this long-overdue measure to alter the California Constitution. We will conduct further analysis.